The 2022 990 tax return for Toastmasters International has been released. Total revenue was down 10%, and expenses were up by $5.6M (24%), resulting in a “loss” (revenue minus expenses) of $2.6M (compared to a gain of $6M in 2021). Total salaries were up 3.5% (48% of all expenses, down from 58% in 2021), and the number of employees is essentially unchanged at 164 (up by 1, less than 1%).

Expenses and vendors

The largest increase in expenses by dollar amount were district expenses (up $2.1M), “Conferences, conventions, and meetings” (up $1.1M), “other” (up $812K), property taxes ($633K, not previously broken out), travel ($633K; this was the first in-person convention after the pandemic), payroll (up $468K), and information technology (up $337K).

- Payroll (including all related expenses, like benefits and pensions) was by far the largest single expense, at $13.8M (up $468K or 3.5% from 2021).

- District expenses were up $2.1M or 62% at $5.4M (but still well below 2019 pre-pandemic levels at $9.7M).

- Depreciation was up 24% to $1.7M.

- “Conferences, conventions, and meetings” was up 186% (nearly tripled) to $1.6M (from $0.6M)

- Information technology was up 38%, to $1.2M.

- “Other” is up $812K to $2.1M, from $1.3M in 2021. (The IRS does not require this to be broken out into detail as long as it’s below 10% of the total expenses, and this is 7.5%.)

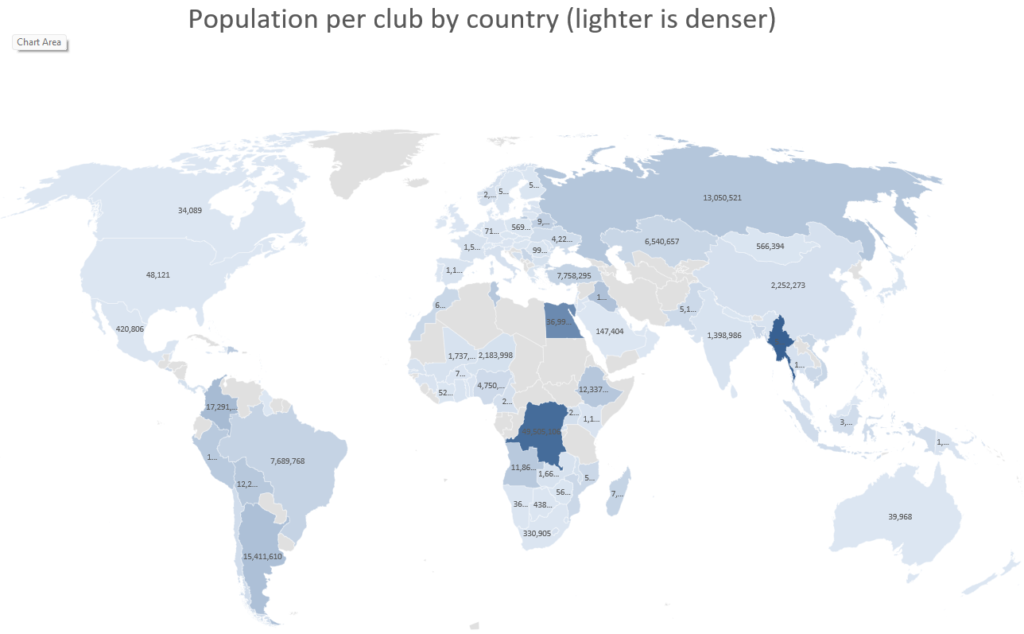

Expenditures on club-building and leadership training by world (not TM) region are interesting, it does cost significantly more to support members outside of North America. Much of this increase is just a return to pre-pandemic normal levels, such as in-person training and meetings.

- North America, $651K (doubling $326K for the previous year)

- East Asia/Pacific, $1.3M (up from $945K)

- Middle East/North Africa: $415K ($94K)

- Sub-Saharan Africa: $294K ($239K)

- Central America/Caribbean: $101K ($20K)

- South America: $45K ($13K)

- South Asia: $745K ($400K)

- Europe, $538K ($243K)

- Russia and neighboring states, $24K (a new category for 2022)

The five largest vendors for Toastmasters were:

- Cornerstone Ondemand, $923K (up from $880K the previous year, the Pathways web site)

- Dynatech Systems, India, $741K (up from $512K, “IT and software services/support”)

- Intrado Digital Media (now named Notified), $613K (not listed in 2021, “web casting, audio/video production”)

- Sourceved, India, $508K (up from $393K, “software development”)

- RR Donnelley & Sons, $439K (down from $1.1M last year and $2.8M the previous year, logistics and communications, most TI store sales

12 more companies were paid at least $100K (each) in 2022.

Employee compensation

Staff designated as key must have compensation publicly reported (per U.S. non-profit tax law), listed below.

- CEO Dan Rex, $411K base compensation (up 0.5%) plus a $66K bonus (same as 2021, 16% of base), for $517K total compensation (0.1% decrease due to some lower benefits)

- Chief financial officer John Bond, $306K (includes a 4.8% bonus, total comp up 1% from 2020)

- Chief information officer Heidi Hollenbeck, $292K total comp (new this year)

- Senior director enterprise app & project Michael McGurk, $200K (new this year)

- Controller Margaret Yamamoto, $191K (5% increase)

- Marketing/communications director John Lurquin, $190K (11% increase)

- HR director Gary Kinser, $175K (1% decrease, also due to some lower benefits)

- Partnership and development director Angela Cunningham, $160K (4% increase)

- Club quality and member support director Danielle Mitchell, $159K (6% increase)

- Secretary/education director Kathryn Rynerson, $158K (5% increase)

The CEO’s compensation was established using a compensation committee, a compensation survey or study, and approval by the board or compensation committee (per the tax return, Schedule J). This year (like last year), the tax return indicates that the form 990 of other organizations was not used and that there was no written employment contract, while those boxes have always been checked in recent years. This is the second year that an independent compensation consultant was used.

Expenses included paying for companion travel (as in previous years), and did not include any first class/charter travel or tax indemnification/gross-up payments (per the tax return). There is a written reimbursement policy, and substantiation of expenses is required.

Revenue and assets

Total program revenue shrank by 3%, to a total of $26.8M. The Toastmasters district conferences globally took in $887K in revenue (up sharply from $286K in 2021, but nowhere near the $3.7M in pre-pandemic 2019). The annual convention pulled in $720K (up from $214K in 2021, and getting closer to the 2019 level of $1.0M). For materials sold, the sales revenue only covered 6% of the cost, resulting in a $2.1M loss on sales (better than the $2.4M loss in 2021). In 2021, the loss was 85%, in 2020, the loss was 82%, in 2019, the loss was 47%, in 2018 the loss was 51%, while in 2017, there was a 6.8% loss.

Total assets shrank by 5.3%, to $59.8M, of which $32.1M is cash and investments, equal to 1.12 years of expenses (compared to 1.53 years in 2021, 1.23 years in 2020, 0.65 years in 2019, 0.63 years in 2018, 0.52 years in 2017, 0.56 years in 2016, and 1.2 years in 2015), in the range of the recommendation for non-profits to have 1-2 years of expenses saved up in reserves. The land and building at WHQ is valued at a net of $25.5M (down 1%). Inventory has decreased by 13% (after decreasing by 14% in 2021, 16% in 2020, and 13% in each of 2019 and 2018), to $435K.

Net assets shrank by $3.3M (5.3%), mostly due to $2M less cash and $1.1M less investments. Liabilities are up somewhat, mostly due to $1.1M more in accounts payable.

Related organizations

Three organizations are identified as related, “Toastmasters International Singapore Ltd”,“Toastmasters International (Hong Kong) Ltd”, and “Shenzen Toastmasters Culture Exchange”, all companies for “legal and compliance administration” (also controlled by TI).

One contributor of over $5K is listed, with that person (name redacted, as permitted by IRS regulations) contributing $7,199.

Click here for the full 2022 tax return.

2021 tax return analysis

2020 tax return analysis

2019 tax return analysis

2018 tax return analysis

2017 tax return analysis

2016 tax return analysis

2015 tax return analysis

2014 tax return analysis

2013 tax return analysis

2012 tax return analysis

2011 tax return analysis

The 2018 990 tax return for Toastmasters International has been released. Total revenue was up 10.0%, and expenses were down 4.0%. Total salaries were down 12.9% (34% of all expenses, down from 37% in 2017), even though the number of employees is up from 181 to 236 (up 30%, partly a recovery from staff loss during the Denver move the previous year).

The 2018 990 tax return for Toastmasters International has been released. Total revenue was up 10.0%, and expenses were down 4.0%. Total salaries were down 12.9% (34% of all expenses, down from 37% in 2017), even though the number of employees is up from 181 to 236 (up 30%, partly a recovery from staff loss during the Denver move the previous year).